Every year millions of Americans become victims of consumer fraud. Fraudsters use old tricks and new technology to deceive consumers. Understanding consumer fraud can help people protect their loved ones and themselves from becoming victims. Common types of consumer fraud include telemarketing fraud, identity theft, and mortgage scams. These schemes involve false, misleading, or unfair business practices that deceive consumers.

Be Wary of Telemarketing Calls

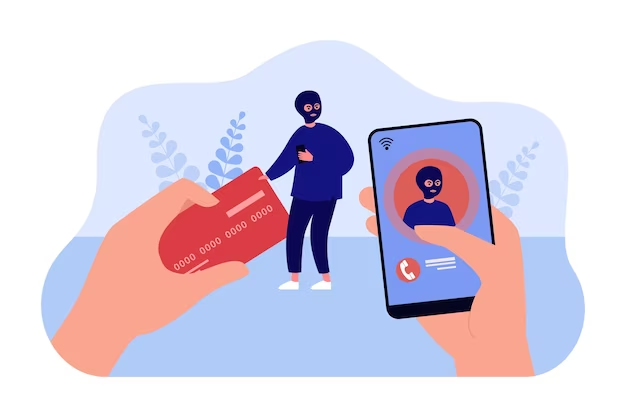

Consumer fraud can take many forms, from bogus credit card charges to identity theft. Each year, Americans lose billions to scammers, who are more convincing than ever and often target those in vulnerable situations. Consumers may, however, take easy precautions to prevent falling prey to consumer fraud. One of the most common types of consumer fraud is telemarketing scams. These scams can include claims that you won a prize or sweepstakes, that you have a problem with your credit card, that someone in your family has a medical emergency, or that you are behind on your mortgage. In addition, some telemarketers try to get consumers to invest in phony investments or buy expensive “promotional items” such as magazine subscriptions. Scammers sometimes pretend to be government or law enforcement officials and use caller ID spoofing to make it look like they are calling from a legitimate source. Scammers want you to act quickly, and they may even threaten you. Before you send money or give your personal information over the phone, slow down and think about it. Ask a family member or acquaintance you trust to verify the data or look it up online. If you are worried, speak to a consumer fraud lawyer to discuss the problem with a qualified expert.

Do Not Give Out Personal Information Over The Phone

Consumer fraud occurs when an individual suffers a loss from deceptive, unfair or misleading business practices. Fraudsters often target vulnerable consumers, such as seniors and college students. However, everyone is at risk of being scammed. There are many types of consumer fraud, including identity theft, credit card fraud, mortgage fraud, fake charities, and lotteries. Be aware of unsolicited phone or email demands for money or personal information as a way for consumers to guard against falling victim to consumer fraud.

Many scammers use scare tactics, emotional manipulation and undue influence to steal a victim’s money or personal information. They may also exploit the victim’s fear or sense of urgency to persuade them to act quickly. Fraudsters are using innovative ways to steal personal information. For example, they can use a mobile phone’s SIM card (a removable device holding the phone’s unique ID) to link it to another SIM card on a different phone and access private texts, apps, cloud and email accounts. They can even reset credentials on their victim’s social media accounts.

Don’t Pay For a Service You Don’t Need

Millions of people are scammed out of their hard-earned money yearly through fraudulent and deceptive business practices. Consumer fraud can be anything from identity theft to mortgage, credit card or bank account scams, fake charities, and lotteries. While criminals typically target college students and senior citizens, anyone can be a victim of consumer fraud. The number one way to avoid being a victim of consumer fraud is to never pay for a service you don’t need. It means you should never send cash to someone over the phone and always think twice before sending a check or using reloadable cards. It’s also important to be careful when shopping online. If you are unsure whether an online payment is legitimate, contact the company immediately before sending your money. You should also avoid sending money through services such as Western Union and MoneyGram, as it is nearly impossible to get your money back once you send it.

Another thing to remember is that if you are offered a loan or credit card, it is against the law for anyone to ask you to pay an advance fee to receive the product or service they promise. It is commonly known as 4-1-9 fraud (after the Nigerian section dealing with these scams). Legitimate lenders will not charge you a fee upfront to “guarantee” your loan or credit.

Don’t Give Out Your Credit Card Number Over The Phone

Whether it’s an unsolicited call, a text message or an email, crooks are using new technology and old tricks to scam millions every year. Sadly, many victims lose their hard-earned money to these criminals. While paying with a credit card over the phone is common, you should only give out your number to someone if you initiated the call and are talking to a company or bank you trust. Fortunately, credit cards have pro-consumer fraud dispute processes, and federal law limits consumer liability to $50 for fraudulent purchases. Similarly, debit cards have similar protections. There are legitimate reasons to pay over the phone, such as ordering a delivery or paying a bill with a small business that doesn’t accept credit cards. However, in this case, you should use a secure Wi-Fi connection to avoid exposure on an open or public network and consider a password manager and 2FA (but not SMS). If you need to provide your credit card information over the phone, call the business using its published contact information and a keypad payment. Alternatively, you can use a trusted third-party service that uses VoIP and scrambles your data to keep it safe from hackers. Signing up for credit monitoring is also a good idea, alerting you of suspicious activities in near real-time.